Updates on the Montana Property Tax Rebate

Deadline to apply is October 1.

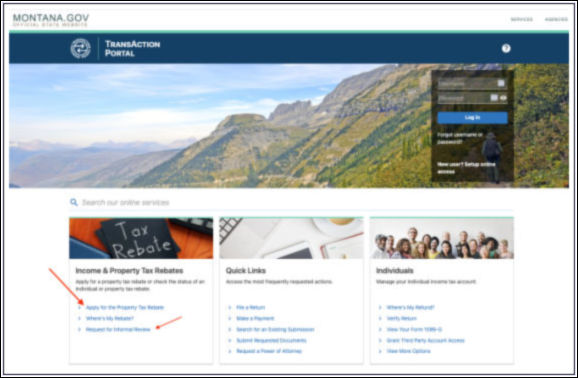

Here is a screenshot of where to locate the rebate application on the Montana TAP website (https://tap.dor.mt.gov/_/):

It has been just over a month since the Montana Department of Revenue opened the application portal for the Montana Property Tax Rebate for 2022.

Some general updates and clarifications to note:

The max rebate amount allowed will be $675 and should not exceed the property tax amount for the 2022 year. For example, if a taxpayer owed $425 in property taxes, the rebate amount will equal $425. If a taxpayer owed $1,200 in property taxes, the rebate amount will equal $675.

As of August 24, the Montana Department of Revenue stopped issuing the rebates via direct deposit. All rebates issued after August 24 will be sent via check and mailed to the address listed on the rebate application.

Taxpayers should be aware that if they have an outstanding obligation with the state, the property tax rebate will be applied to that debt first before issuing to the taxpayer any remainder of the rebate total.

If a rebate is denied and the taxpayer disagrees with the state’s determination of the denial, the taxpayer has the option of filling out a form called Request for Informal Review. There’s a link on the TAP webpage, or, here is the link to that form:

Request for Informal Review (Form APLS101F)

October 1, 2023, will be the last day to apply for the 2022 Montana property tax rebate. The state will accept no applications submitted after this date.

For further instructions on what is required to receive the Montana Property Tax Rebate, please go to the Montana Department of Revenue’s website.

* This article is not a complete listing of all the details related to this business / accounting topic and you should contact your CPA for a more detailed discussion regarding these items and how they may apply to your specific situation.