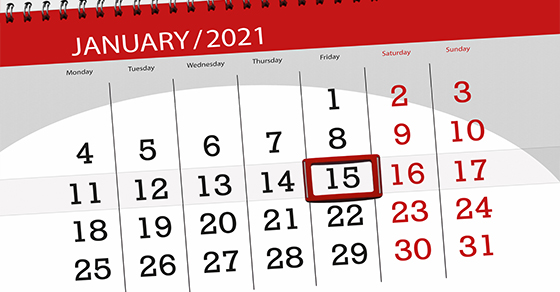

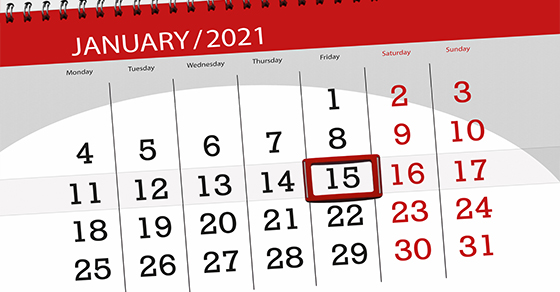

The next estimated tax deadline is January 15 if you have to make a payment

If you’re self-employed and don’t have paycheck withholding, you probably have to make estimated tax payments. These payments must be sent to the IRS on a >>

If you’re self-employed and don’t have paycheck withholding, you probably have to make estimated tax payments. These payments must be sent to the IRS on a >>

As we near the end of this epic year, we truly hope you and your family are healthy and happy. We also hope that even with >>

With the year nearing its close, our team offers this comprehensive tax planning guide directly to you! This guide helps break down major tax changes and >>

Join us for our year-end update on payroll developments including updates on the Cares Act and the Payroll Tax Holiday, a how-to on Fringe Benefits, and >>

The IRS is reminding employers that they must file Form W-2 and other wage statements by Feb. 1, 2021, to avoid penalties and help the IRS >>

Year end is traditionally when auditors observe physical inventory counts. These observations help auditors verify that the amount reported on your balance sheet matches what’s held >>

You’re Invited! Episode 6 of our 6-part series is here! Episode 6: Wrap Up – What Does it All Add Up To? – Thursday, December 3 >>

Happy Thanksgiving to our clients, families and friends. Our offices will be closed November 26th & 27th so our team can spend the holiday with their >>

Many employees take advantage of the opportunity to save taxes by placing funds in their employer’s health or dependent care flexible spending arrangements (FSAs). As the >>

If you have a traditional IRA and take a distribution before age 59 ½, the amount is subject to income tax and you’ll generally owe an >>